Originally sent to VIXCONTANGO subscribers on September 10th, 2017

After the Bitcoin network was around for a while and it turned out to work pretty well for sending money from one account to another, at some point it was time to move onto the next phase. Many people wanted to make improvements to the Bitcoin network, whether to make mining easier or fairer or to make transaction processing faster. We discussed some of those technical improvements in our prior emails. But some others thought of the Bitcoin revolution in a completely different way.

As a payment system, the Bitcoin network was created as a direct competitor of the US dollar. Since World War 2, all international transactions have to be settled in US dollars. It used to be gold, but now it is electronic dollars. The US abuses this powerful mechanism to persecute people, groups or countries that don’t agree with its interests or agenda and for a long time there has been a desire in the international community for a replacement or at the very least for a viable competitor of the US dollar. Simply put many individuals, corporations and nations want to be able to make payments between each other outside of the control of the US government. From the ether of nothingness came Bitcoin, created by an unknown software architect, adopted by the open source anarchists and beloved by the outcasts. Seedy as its beginnings may have been, the Bitcoin network managed to do what no government, corporation or other institution has been able to do since WW2. Conduct business outside the iron hand of the sophisticated US government and its dominant military.

So if the US government and other governments use payments for control, what else can be used for control? How about computing power? Every computing activity, whether storing files, transmitting files, etc is done on some computer that pays for its electricity in some currency that is controlled by a government. Every computer application is provided by a corporation or an individual that is ultimately depended on the government in some way. Most of the computing resources we use these days is either email from Yahoo, search from Google, a spreadsheet or word processing from Microsoft, music from Apple or video from Netflix or Amazon. It is a few corporations that have enormous control over our lives because they provide the computing power and most important usages of that computing power.

Vitalik Buterin was born in 1994. He is barely 23 years old today. At 17 (2011) he started running a magazine focused on Bitcoin called appropriately “Bitcoin Magazine” which was the first news source for cryptocurrencies. He did that for a couple of years but he quickly grew frustrated with the limitations of bitcoin and with members of the Bitcoin community who treated the original source code of Bitcoin like the tablets of Moses and were resistant to any changes. He foresaw the larger revolution that Bitcoin unlocked and wanted to push the action in that direction. So while most people his age try to figure out how to date a girl, Vitalik Buterin attempted something far simpler – create The Distributed World Computer.

The core concept of Ethereum is rather simple – to provide a distributed computer network whose job is to provide computing power. Basically a Giant World Computer that anybody can use to run whatever application they want on it. You can think of it as a giant Cloud Computer that is not run by Microsoft or by Google or by Amazon, but by the same amorphous and anonymous group of people that run Bitcoin – a bunch of miners that can be located anywhere in the world, live in any jurisdiction. They can be anybody. For all it cares, the miners can be just computers that run in outer space. Completely free and unfettered. This Giant World Computer can then allow developers to create applications that live on this Giant World Computer free from corporate or nation state control. Those are applications that can’t be killed by censorship or by law enforcement actions. Vitalik Buterin wanted to circumvent how everything is done today and base it on a distributed network that can exist by using the same redundant and self-preserving reward mechanisms that bitcoin uses. To put it simply, if somebody will take out Google one day or at least form a viable competitor, it will most likely be an application built on the Ethereum network. If you want to get a true uncensored Twitter, it would most likely be on the Ethereum network. There are a lot of moral questions to think about when you think about a truly decentralized network and what that means, but the question here is not what the moral implications are but whether it can be done or not. And it seems like it can be done.

So from the get go, Ethereum is more than just a protocol to send money. It is an operating system on top of which you can program applications. And since Ethereum is more developer friendly than Bitcoin, it almost immediately got the support of Microsoft. While much of Silicon Valley is betting on Bitcoin, Microsoft is betting big on Ethereum. Ethereum has its own computer language called Solidity. The Ethereum Virtual Machine now runs on Azure and Microsoft Visual Studio has a plug-in that allows people to write Solidity code that can run on the Ethereum network. Having the backing of Microsoft and allowing Solidity access to Microsoft’s army of 30 million developers is no small deal. Without going into much detail, the reason why developers like Ethereum a lot is because it allows them to tinker with every aspect of it. Unlike Bitcoin which is like an Apple computer where everything is set in place, Ethereum is like Windows computer – to one person it can look one way and to another a completely different way. Thus long term Ethereum will be heavily adopted by the business community which can tweak it in ways that it suits their purposes best.

Ether is the currency that is used by the Ethereum network. Ether is what is mined. In order to use resources of the Ethereum network you have to use Ether to pay. You can purchase and store Ether in a Coinbase wallet using US dollars. Ether can be traded for Bitcoin on almost all cryptocurrency exchanges like GDAX, Gemini, BTC-e, Poloniex, Kraken, etc. Ethereum is just as easy to buy and sell and store as Bitcoin. As a result of this relatively quick mainstream adoption, Ethereum has gone from $12 to $380 this year. And I have to say its actual industrial adoption is still in its infancy. So who knows where the limit of this is if it is trading at $380 already.

Unlike Bitcoin, there is not going to be a fixed amount of Ether for all time. The Ether supply is not limited but will expand over time. About 60 million Ether were created during the Ethereum Initial Coin Offering in Aug of 2014 for about 18 million USD. The actual price was 2000 ETH for one bitcoin. After that offering, Ether creation is capped at 18 million Ether per year. 5 Ether are created during each block and each block is mined every 15 seconds. So most people put estimates that about 10 million Ether will be created each year. So right now there is about 100 million Ether give or take (rouhgly 95 million is the actual number) and the market cap is about $36 billion (with a B). Next year there will 110 million ether, in 2019 120 million, in 2020 130 million and so on. While the supply keeps increasing, it will increase by a smaller percentage as time goes on, so Ether while not as tight as Bitcoin, will still be a somewhat limited commodity as time progresses.

Smart Contracts

So while the concept of the Distributed World Computer is very exciting to modern day revolutionaries and one day may actually become a reality and we might even have usable distributed applications (DAPPs) running on it that, for example, allow us to search the internet or write a document, we are only at the infancy of this technology and as such not much can be done with it today. Most serious applications are at least a few years out because it takes a long time to make a good usable application. But there is one BIG thing that can be done with it today. There is a killer app that has fascinated the business community and this app is the reason why we are talking about Ethereum today. This app is the Smart Contract.

What is a Smart Contract?

As you understand by now, Bitcoin is a way to make payments without a government or corporate intermediary that can shut down the flow of payments for an arbitrary reason. Payments are pretty much what business is all about and what business contract law is all about. People enter into financial contracts in order to figure out when to make or receive payments and under what conditions. A traditional contract is written on a piece of paper, usually with the help of a lawyer. If some data is required to be collected that are specified in the contract, an Audit is performed. If people are confused about the terms of the contract, they go to a judge that says who should get what and how much. Then the government (the judge) has the power to withhold wages, block people’s financial accounts and do all kinds of things to collect the money that a person needs to pay to honor the contract.

With the advent of Ethereum, now it is possible to automate law and the execution of a financial contract. Instead of writing a contract on a piece of paper, you can write it using a computer language (in Ethereum’s case that language is Solidity). That contract can then be stored on the Blockchain and when the conditions of the contract are met, then a payment can automatically be taken from one account and sent into another. Think about that for a second? You can use computers to automate one of the most inefficient parts of the economy – CONTRACT LAW.

People don’t know this but writing was not invented so that a boy and girl can tell each other how much they love each other. There have been non-verbal ways to express love since the beginning of time. Writing was originally invented to record and collect debts. To write rules of the law. Writing finds its origins in law and in finance. What Ethereum allows, far better than Bitcoin or any other technology, is to move LAW into the computer age.

It is not difficult to see widespread applications for this. For example, sports betting. An example smart contract is 2 people put money in an account and then depending on the final score of the game one guy gets the money and the other doesn’t. All automatically executed. What about a will? A person can specify the terms in a smart contract and once his death is recorded on the blockchain, then certain accounts automatically get funded. Some applications can go even further and target the connected home. Imagine you have door locks that are connected to the internet. You set up a smart contract with a renter. If the renter doesn’t make a monthly payment, the door doesn’t open. You can rig a car in a similar way. If the person doesn’t make the monthly lease payment, the car doesn’t start. There can be many applications of smart contracts living on the Ethereum blockchain.

Essentially, Ethereum becomes a competitor of the established payment and settlement systems. Real-time settlement systems are many. Fedwire is the one operated by the US Federal Reserve Banks. CHIPS is the Clearing House Interbank Payments System. CHAPS – Clearings House Automated Payment System of the United Kingdom. CNAPS – China National Advanced Payment System. TARGET2 – settlement system for the Euro currency. Ethereum competes with all of those. There are more than 400 billion transactions processed every year in the world and the transaction volume increases about 7% per year on average. VISA for example processes about 50 billion transaction per year or roughly 12% of the total. If Ethereum gets anywhere near that it will have to have VISA’s market cap which is about 250 billion. Mastercard’s market cap is 150 billion. The major payment companies in the word have a total market cap of about $500 billion today. Ethereum current market cap is $40 billion.

Some think that SmartContracts will one day be a replacement for lawyers. While I can definitely see automation of law, I think it is a bit premature to say that we will not need lawyers. We will still need lawyers, but lawyers will have to also double as software developers. Or maybe have paralegals with software skills. It won’t be enough to pass 3 years of graduate law schools, the lawyers of the future will also have to have BS in Computer Science as well. As always, things only get more complicated.

Smart Contract as law has already had some problems. Hackers have been able to misuse the contract language to bleed money out of a Smart Contract. Famously, somebody took around 5 million dollars out of the first Decentralized Autonomous Organization (DAO) last year using a perfectly legal loophole. Before the investors in the DAO could react and fix the code, somebody drained the money and to this day they don’t know who it is. Obviously, real world law also has loopholes that get misused all the time, but Smart Contracts may be subject to loopholes or just plain bugs if the code is not written correctly. In the real world there are institutions that allow certain protections to investors. So far Smart Contracts which are supposed to get around those institutions haven’t been able to provide the same protections. But it is still early and that doesn’t mean that a solution won’t be created at some point.

It is hard to value Ethereum given that it can participate in so many different industries. But it definitely has a bigger potential than Bitcoin. It has terrific growth ahead of it and that growth will be alongside Bitcoin. I don’t think there is single winner here. Both cryptocurrencies can grow big over time.

Initial Coin Offerings (ICOs)

Imagine you wanted to invest in a start-up. In order to do that you have to be a qualified investor (net liquid worth of $2.1 million excluding your house + 200K in annual income), then you have to invest in a venture capital fund where your money is potentially tied for many years before you can take it out. But even if you skip the venture capital fund, your investments in a start-up company is not very liquid. Over the past decade there has been a rise in exchanges where people can trade their private equity stakes, but it is still a rather difficult and heavily regulated process (for obvious reasons). Investing in promising companies early on is certainly not as easy as pulling up a ticker and entering a trade like you can do with publicly traded companies.

Initial Coin Offerings change all of that and make investing in venture capital companies possible for everybody. How does that work? An ICO is basically the first popular implementation of the Smart Contract concept. In an Initial Coin Offering, a special coin is created. A special coin is basically like a share of stock issued in an initial public offering that has some rules attached to it described in a Smart Contract. For example, McDonalds Russia can create a coin that pays a reward for every Big Mac sold. Let’s call it RusskiMcCoin. Investors can buy millions of RusskiMcCoin to fund the creation of McDonald branches in Russia. When those McDonalds branches sell Big Macs, the Smart Contract automatically generates RusskiMcCoin and gives them to the investors as dividend in addition to the RusskiMcCoin they already have. If investors at some point want to sell their RusskiMcCoin they can go to many cryptocurrency exchanges and sell their RusskiMcCoin in exchange for Ether or Bitcoin and from there they can turn them into US dollars or Russian rubles or whatever else. So Initial Coin Offerings can really revolutionize finance given that they are on an distributed network like Ethereum and thus completely unregulated.

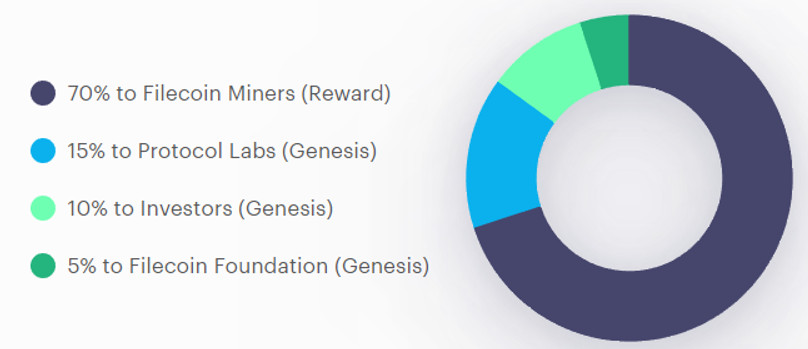

The most common ICOs to date are some new crypto coins with interesting rules that people think are better than Ethereum or Bitcoin. Many companies that want to create decentralized apps, create coins to raise money for themselves instead of going to Venture Capitalists. It is just like crowdfunding but the rules are written by the issuer of the coin instead of some crowdsourcing company. Biggest ICO to date is FileCoin which raised $250 million dollars in August of 2017. FileCoin is a decentralized storage network that will run on Ethereum (which was one of the original dapps envisioned by Vitalik Buterin). Roughly the way this will work, you can become a Filecoin miner and allow your computer to be one of the many that will store files. In exchange for your computer power being used to stored files, you will earn FileCoin which then you can sell later.

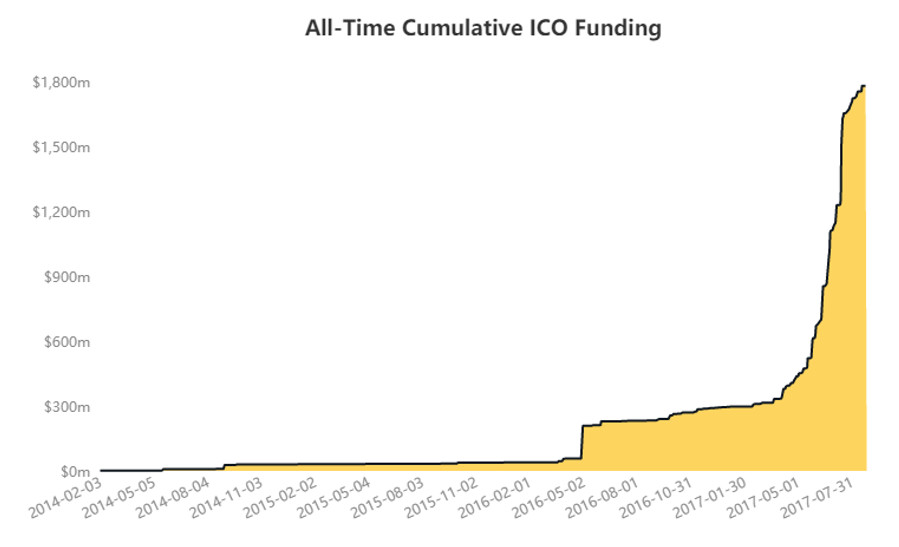

The way most ICOs work, about 10-20% or some percentage of the total coin issuance is being held by the issuer of the coin (a foundation) with the rest designated for a specific purpose (let’s say mining reward). The Ethereum ICO was the first ICO out there and was able to raise 18 million in 2014 and was considered a very successful ICO and laid the model for all subsequent ICOs. Big venture capitalists like Andreessen-Horowitz or Tim Draper have gotten in the ICO game this year and so far, nearly $2 billion has been invested in various ICOs! You can find ICOs listed on websites such as CoinList.co or Coinstaker.com

Where and What To Invest In

First of all, investing in ICOs is not a macro bet. This is more like investing in stocks – you need to know the management team, the rules of the coin – basically you need to be a venture capital investor. The chances are high that you will encounter fraud. I have made a couple of tiny investments like that and they have all gone caput. I would advise following the major venture capital players if you are to invest in ICOs, but as a general rule I highly recommend that you don’t invest in ICOs simply because the venture capital game is not for everybody and even the masters have a 10% hit rate.

For investing, I would simply consider the macro investments – Bitcoin and Ethereum. Those are the platforms on top of which everything else is built and their price grows as the ecosystem grows. They are limited commodities with very well understood rules and I think it makes sense to make a secular long term bet on them.

What does that mean in terms of investing – basically buy and hold. I would not buy the rips however, I would buy the dips. Bitcoin routinely has -25% drops, you can wait to buy one of those. I think in the not so distant future we will have a replay of 2014-15. There are a lot of miners who will eventually want to turn their investment into hard currency and there will be a lot of selling at some point. I can very easily see Bitcoin get back to the $2000 level and even the $1000 level. Going from $4000 to $1000 is a 75% decline and such a decline has happened before and I think it will happen again. In no way is bitcoin as stable a currency as the US dollar or anything like that. You have to invest with the knowledge that it can go down -75% at any point and scale accordingly. However, on a -75% drawdown I would seriously consider tripling down.

One way to invest is basically have a portfolio that is 80% cash and 20% crypto (bitcoin/ethereum) and then every 3 months rebalance. If your crypto currencies are up, you sell them for cash but leave some to ride. If they are down, you buy them back. This way you can ensure that you take some profits along the way and not get exposed fully to a big drawdown.