Originally sent to VIXCONTANGO subscribers on October 31st, 2021

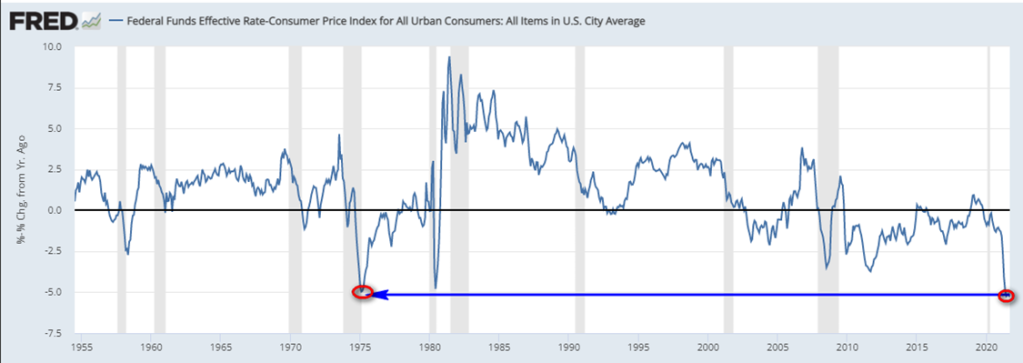

Real interest rates (FED Rate – CPI) are below -5% which is a circumstance that has happened only once in post-war history before: in 1975 in the middle of the tenure of Fed Chairman Arthur Burns (pictured in center above, President Nixon on left, Secretary of Labor at the time George Schultz on right). I consider Arthur Burns to be one of the worst Fed chairmen in history. Here I want to explain what happened during his tumultous tenure, how he screwed it up and what public policy and investing lessons we can draw from his experience today.

Arthur Burns was an immigrant from Eastern Europe. Born in what is modern day Urkaine to Jewish parents, his parents immigrated to the United States when he was 10 once the situtation in Ukraine got really bad for Jews (Ukrainians killed about 1.5 million Jews in the early parts of WW2). Luckily, Arthur Burns survived this horrible ordeal in Ukraine and instead had the good fortune to be able to apply his prolific brain at books, became a good student and went to Columbia University in New York. There he ended up writing a book on business cycles with one of his professors and that book became a reference book on the economy for much of the 60s. From there he ended up at the National Bureau of Economic Research (NBER) – which determines what is a recession or not to this day – where he became a chairman. From there he continued to rise to became a close economic advisor to Richard Nixon during Nixon’s VP years under Eisenhower. Going into the 1960 election, Burns predicted that Nixon will lose the election because the economy wasn’t doing well into the election and indeed Nixon lost a nailbiter to John F. Kennedy. That advice stuck with Nixon and he became obsessed with the economy as a driver of electoral success. When Nixon got reelected in 1968, his first job was to nominate his closest economic advisor Arthur Burns as a Fed Chairman so that Burns would change the course of monetary policy and institute a regime of easy money which would not only help the economy but also make sure that Nixon gets re-elected to a 2nd term. Before I go into details about what happened economically in that Nixon first term, suffice it to say that Nixon’s electoral insight did work for him, since he won in the biggest landslide ever in 1972 with 520 electoral votes with only Massachusets and District of Columbia voting for the Democrat McGovern. Nixon got 60% of the vote in that election and beat McGovern by 18 million votes in the popular vote (out of 76 million). By comparison Biden won with only 8 million over 155 million total votes. The Nixon 1972 template is the reason why Trump was so obsessed with the economy during his short and juvenile one term as President.

Arthur Burns was NOT an ideologue. He was a practitioner. He was neither a Keynesian nor Hayekian. He felt that the economy can’t be explained with a single model and instead different models work at different times and his job as administrator is to use the relevant model depending on the situation. Since he was in the Republican party obviously he was more in favor of market solutions but he wasn’t opposed to bureaucratic solutions if it made sense. He had a very brusque manner, was not diplomatic at all and would strip down intellectually his opponents and embarrass them in debates. He was a typical Eastern European – sharp in every sense of the word. He also liked to puff a pipe everywhere and gave long answers to the media and as such journalists really tried to avoid him because nobody wanted to watch his interviews. So far everything I have seen about Burns sounds like I am describing myself. I haven’t seen a profile of an administrator that matches so closely to the way I think (or the way I was brought to think by my grandfather who was also an public policy administrator around the same time as Burns but in a much smaller economy).

So how did Burns screw it up so badly? Usually the reason why administrators screw up is because they are married too closely to an indeology which eventually reaches the end of its usefulness and then continued application of it ends up producing negative results (“policy overreach”). That certainly was not why Burns failed. He failed not as an ideologue but as a practitioner who used the wrong model to solve the problem at hand. To his defense, he was forced to use the wrong model by his political circumstances.

Burns tenure and failure is a perfect example that economic laws are like laws of nature. Nobody likes them but they are what they are. You mess with them and bad things happen. You might get the desired political outcome but that will be followed by a negative economic outcome. None of us likes gravity either, but if you jump from the 4th story because you think you can fly, you are gonna splash on the ground and die – a very unfortunate outcome. You can’t remove trade-offs. You can only change the trade-offs. Defying economic gravity is something that never works out in the long run either.That is what Burns did and that is why he has such a bad legacy.

Price and Wage Controls

After 8 years of Democratic rule under LBJ, the American economy was sliding into a recession into the 1968 election. The US economy was highly concentrated around the Nifty 50 big corporations (IBM, Big Oil, Procter and Gamble, etc) which were countervailed by an equally big domestic economic opponent – the Big Labor unions. Big Labor organized strikes and halted production at factories around the country and asked for wage and benefit increases. The result of this economic behavior by Big Labor is what we call today “cost-push inflation”. Because labor was on strike, product didn’t get produced. As such the aggregate product in the economy (Q) was below potential. At the same time Big Labor was asking for wage increases. But corporations also need to have certain level of profit (return on capital). Without return on capital, obviously, investors don’t invest. So for a corporation to exist and for labor to get a wage hike, corporations have to hike prices to preserve the profit margins. And that is what they did. With the absence of consumer alternatives (of availability of product), corporations have pricing power and then consumers are forced to pay a higher price. That results in a spiral of increasing prices (P). This should sound familiar because that is exactly what is happening in 2021.

To explain more clearly what was going on, lets use the Monetarist Theory general equation which is a modified version of the Quantity Theory of Money (QTM) discovered by Copernicus: MV = PQ. For our purposes here, let’s assume Money Velocity (V) is constant. Then the equation becomes M = PQ and that makes it more clear what the tradeoffs are. If you reduce production (Q) and you keep money supply (M) stable, you get higher prices (P) as result. That is exactly what happpened at the start of the Nixon tenure in 1969. Big Labor introduced economic friction, reduced output (Q) compared to potential and if monetary authorities (Fed) did nothing (keep M stable), then prices would naturally rise. Same amount of money over less product, you get higher prices. Fairly straight forward.

Here comes Nixon and he is fixated on the M (money supply). He thinks that the economic problem (Q going down) is not because of the Big Labor issues he inherits from LBJ but because the Fed is too tight with the money. He thinks that the country needs to build houses for the Boomer generation and the Fed is not supplying the capital. He puts Burns at the Fed in to implement easy money (or zero to negative real interest rates). Prior to Burns real interest rates were kept around 2% by the Fed. Real interest rates spike up to +4% in the first year of Nixon (1969) as the Fed hikes rates to almost 9% in 1969 in response to rising cost push inflation. Fed Chairman William McChesney Martin at the time thinks that to control the cost push inflation you have to reduce the M. If the Q is going down to keep the price level stable, you need to lower the M. But that results in unemployment and a bad economy and Nixon definitely does not want unemployment going into the 1972 election. He can’t allow the Fed to make the same mistake it did in the Great Recession of 1930s when the Fed went tight with money (lowered M) in order to keep prices stable, but induced an additional recession (lower Q).

Nixon puts his man Burns at the Fed to change Fed monetary policy. Burns starting in February 1970 takes out the axe and start chopping interest rates and reduces them from 9% to 3%. In real terms they go from 4% to -1%. That is your typical -5% loosening of interest rates to counteract recession. By the start of the Burns tenure in February of 1970 the economy is in recession. The cutting works and economy recovers in 1971 but the recession lasted the entire year of 1970 and Nixon and Republicans suffer a big defeat at the polls with Democrats gaining 12 seats in the House and flipping a number of governorships across the country. Nixon again looks at the bad economy and his mid-term electoral defeat and is even more convinced that the economy is key to electoral success. 1971 comes in and the economy recovers and Burns attempts to raise interest rates. Nixon goes ballistic at him because he wants the interest rates to be kept unchanged at 3% and moreover he doesn’t want rates raised in front of 1972 which is his reelection year. Burns relents and lowers rates in 1972 from 5% to 3%. But Burns understands QTM and that if you keep monetary supply (M) expanding and the product in the economy is not doing great (Q is stagnant), you will still get inflation (P). So Burns needs to something else to combat inflation which was nearly 10% in 1970 and is very fresh on voters minds.

Burns decides to implement what are called today “Wage and Price Controls” policy. Burns starts to undercut Nixon and gathers a Congressional coalition to agree to allow the government (or the bureaucracy) the ability to intervene in disputes between Big Corp and Big Labor to keep prices and wages under control. Whenever the private sector negotiations go haywire the government (public sector) can step in and resolve the dispute. The Economic Stabilization Act of 1970 passes with veto proof majority and gives Nixon that power. Nixon initially doesn’t want to use it because he is after all a conservative and believes in free market solutions first – Big Labor and Big Corp should figure it out on their own. But Burns makes it clear to him if that M is going up and P is going up then Q is going down and Q doing down means unemployment. Nixon needs to fix the Q himself though regulation. To his great chagrin Nixon steps in and uses government authority to arrest prices for 1 year in 1972. He creates the Economic Stabilization Program (ESP) with the Cost of Living Council headed by none other than Donald Rumsfeld. Rumsfeld manages to keep prices and wages down and the economy good enough for Nixon to win in the biggest landslide ever in 1972.

After Nixon wins reelection, Nixon admits that Burns did the “right” thing with “Wage and Price Controls” and the relationship gets repaired. He allows Burns to do his job and renominates him in 1974. Right after the 1972 election Burns proceeds to raise rates from 3% to 12% as inflation rises to 12% by 1974. Nixon also let the ESP expire in 1974 and the “Wage and Price Controls” program is viewed at the time as a success. All of Nixon’s and Burns’ policies were certainly a political success but not an economic one. By 1974, the Nixon economy is again in big trouble. The Big Labor situation persists and keeps Q low and thus P high. In addition to the continuation of these domestic problems, Nixon’s meddling with the money supply and the US dollar has international ramifications. Let’s not forget that one year before the 1972 election in August of 1971, Nixon also closes the Gold Window. The price of Gold is no longer set by the US government, but by the market. This is a huge development in international finance as the Bretton Woods agreement is shredded by the Nixon administration.

Nixon’s meddling with the money supply to enhance his political fortunes is at the very minimum met with resentment by other politicians around the world who would like to do the same thing for themselves but are constrained by the Bretton Woods agreement. Why should Americans do that but not us? When the world entrusts a country with the reserve currency, the type of meddling that Nixon orchestrated is simply unforgivable. That’s like entrusting your money to a lawyer for custody of your kid’s trust funds and the lawyer instead disburses the money to himself. It’s cheating plain and simple. That is the one error that cannot be made. Nixon’s first term kicks of a series of events which leads to an international loss of confidence in America’s ability to manage the world’s reserve currency. That leads to various countries starting to act in their own best interest and results in the oil embargo in 1974 and general decrease in commodity supply. This in turn leads to a number of commodity price shocks which lead to ever increasing inflation in 1973 and 1974. So the temporary efforts that Burns and Nixon orchestrated in 1971 to tame inflation for the 1972 election come back to bite them back in a big way. By 1974, Nixon is ousted and Gerald Ford comes in his place. The situation starts to come back under control but Burns decides to keep real interest rates negative all throughout 1974, 1975, 1976, 1977 and 1978. Basically for as long Burns is Fed chair, real rates would be negative. Throughout 1975-1978 period, Burns gives up on managing interest rates actively and sets them at about 5% for a 4 year period regardless of where inflation is. Inflation initially declines from 1975 to 1977 but then starts to rise into the end of Burns tenure. By that time, the Democrat Carter is elected and a new round of strikes get orchestrated by Big Labor which combined with the negative interest rates of Burns (Q goes down and M goes up) results in massive increase in prices (P). Inflation rises all the way to 15% in 1980.

Paul Volcker is installed by Carter in 1979 as a successor to Burns and Volcker has no choice but to hike rates dramatically and end the Burns regime of negative real interest rates. You can’t have M going up with Q going down. Volcker raises real interest rates to as high as +8% in real terms to arrest the cost push inflation pressures. The situation really doesn’t get resolved completely until the Reagan presidency when Regan breaks the collective bargaining power of the unions under the advice of George Schultz and thus breaks the original cause of the inflation problem. Strikes are ended, production (Q) increases, wage pressure subside and real interest rates are held at +5% for a decade (M is down). That combination of tight money and deregulation finally solves the inflation problem of the 70s. However, it is key to understand here is that tight money part of the solution was implemented by Paul Volcker (a Democrat). President Carter knew that tight money will doom his presidency but he sacrificed his political life for the good of the country and appointed a Fed chairman who will pursue tight money policies. In addition, deregulation of Big Labor started under Carter. President Carter did a lot of things that were directly against his own political interest but for the good of the country. And that is why Carter gets an enormous amount of respect today. He was seen as a political failure back in his day, today he is seen as an American giant and a big time patriot.

Lessons from the Burns tenure

As we look at the US and world economic situation today what are the main lessons that can be drawn from the Burns tenure as Fed chairman in the 70s?

The first and most obvious lesson to me is that Biden can’t afford to renonimate Powell to the Fed chairman spot. You absolutely can’t have an “appeaser” in the Fed chairman spot who kowtows to the executive branch instead of listening to the economic formulas. Powell has shown a lack of spine – he lowered rates in 2019 ahead of 2020 election for no reason other than to appease Trump and juice up markets. He is known for meeting with Congress constantly. Powell is a political animal and politics can’t be allowed to meddle with the money supply. What Powell and Trump did in 2019 with the money supply has again ruined America’s reputation abroad and America is now again not viewed as being a good steward of the world’s reserve currency. For that reason, an alternative reserve currency – Bitcoin – has seen rapid adoption in its place. While in the 1980s, during the Reagan administration, many countries dropped their own domestic currencies and adopted the US dollar, now the opposite is happening: countries are looking to de-dollarize. A prime example of this is El Salvador. El Salvador was on the dollar standard for the past 30 years but in the last 4 years the El Salvador government has lost faith in the American government. El Salvador has turned to Bitcoin for an answer. El Salvador will not allow domestic political considerations in the US to affect the wealth of their country. Note that Vietnam’s Project Bakong has the same aim – de-dollarize. Many other countries are making the same decision and that is why you see the explosion of crypto over this year. The only way Biden can restore confidence in the US dollar is to remove Powell and install a competent apparatchik similar to Volcker. I am not sure that Brainard is exactly that person but Brainard is 10 times better than Powell. At this point Powell is damaged goods and clearly needs to be replaced. If Powell doesn’t get replaced, you have no idea how fast Bitcoin is going to get to $500,000.

The 2nd lesson is that the US needs to avoid a return of Big Labor shutdowns. October 2021 is now called “Striketober” by the media because there were so many strikes and factory shutdowns across the country. Just as the international supply chain is clogged we have factory shutdowns. With Big Labor shutting down plants and lowering the product pushed into the economy it is inevitable that inflation will continue to go up in a “cost-push” spiral higher. Add to that COVID. COVID is also a problem abroad so the problem is not just domestic but everywhere in the global supply chain. It is clear that the global economy will have constraints on production for a long time. That means that the Fed has to switch from an easy monetary policy to a neutral one at the very minimum to control prices. We might even need a tight monetary policy.

Further fiscal stimulus will also increase inflationary pressures in the near term. That is why Senator John Manchin has brought out the axe is cutting unnecessary spending left and right in the Build Back Better plan that is currently being negotiated. Inflation pressures are real and if unaddressed will go from transitory to endemic. In particular, Biden’s clean energy initiative of building electric car charging stations across the country is bound to be inflationary. If you put blue collar workers to work on electrical stations, you rob the housing industry of its workers. Since the housing industry is operating at max capacity that means housing prices shoot up. Housing prices are substantial part of the CPI. Biden also doesn’t want to open up oil production. That keeps energy prices high. So if housing and energy prices go up, you are talking about 60% of the CPI index with serious upside pricing pressures. So even though the intent of the green portions of the BBB bill is benign, it will end up driving up inflation and exacerbate a bad housing shortage in the US. Don’t forget Putin can’t wait to induce another shock on the Biden administration. Russia made oil negative in 2020 and they can make it $200 in 2022. The Biden administration is making Putin the leading actor in the pricing of oil and Putin relishes the opportunity to cause economic chaos to the West at the right time.

To avoid a massive inflation spiral similar to the Carter administration you need to see an end to the Big Labor strikes and to green stimulus efforts. I am not sure the Biden administration is capable of that because of ideology. So it seems that Biden is boxed in a similar way to Carter. The only difference between Biden and Carter is that Gold is no longer the main inflationary outlet. Crypto has taken its place.