Originally sent to VIXCONTANGO subscribers on December 11th, 2022

Rule of #1 of intelligence is “There are no coincidences”. The question always is “Why is this happening?” and “Who is doing it and how?” The answer is never “it is a coincidence”. The question I posit here is “Why is Bitcoin happening?” and “Who is behind Bitcoin?”

The Bitcoin white paper was published on October 31st, 2008, 5 days before the election of Barack Obama which turned out to be a historic moment for America and not in a good way. Is it a coincidence that Bitcoin is released exactly the week of Obama’s election? Absolutely not. Bitcoin could have been released a year earlier or a year later. Its release on the Friday night right before the Obama’s election simply can’t be a coincidence. It is a statement.

When do government agencies release things to the public? Always on Friday. That is a big hint right there.

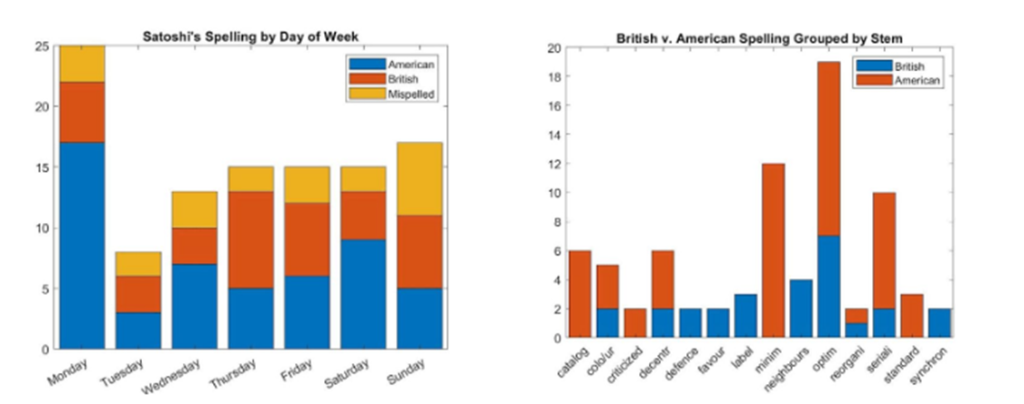

Now that we have observed more than a decade of attempts to create Layer 1 protocols that compete with Bitcoin (Ethereum, Cardano, Solana, Avalanche, Cosmos, etc) we know that to create a real decentralized L1 protocol you need a team of genius computer scientists/professors with top pedigree from the world’s premier universities as well as software developers with 20 years of experience in multiple specialties some of which are the most difficult in the world such as distributed computing, computer security and cryptography. In other words, some dude in a basement can’t create Bitcoin. No one knows that much. Bitcoin was written by a TEAM of minimum 5 top notch technologists with vastly different areas of expertise. Most likely the team was about 10 to 20 people. Analysis of the English language usage of Satoshi shows inconsistent use of American and British words and idioms. Satoshi wrote British on Tuesdays, Fridays and Sundays and American on Mondays, Wednesdays and Saturday. How bizarre, right? I don’t know of a single person who writes British and American English at the same time. This software was clearly written by a team of about 10-20 people with such level of privacy and detection evasion as to no one to being able to pinpoint who this team of people is to this day. We are talking about 10-20 people slipping through undetected in 2007 and 2008. All of them. Pretty wild, right? This happening in a world, where some guy at the MI5 or the CIA can easily setup an alert to track every time I leave my home because the GPS coordinates of my Apple phone moved 100 meters.

In other words, Bitcoin was created by an entity with state level resources. Who are the states who have the technical personnel with the ability to create a Bitcoin network? The US/England is one, China, Russia, European Union, Japan and maybe a few others. But the big 3 here really is US, China and Russia. One of these 3 created it. Or maybe they collaborated to create it.

The question is if they did collaborate to create it, what was the reason? And if they didn’t collaborate to create it what was the reason that each one of them would have to create it? Let’s dig in some more.

America

In light of the Multi-Polar World Order (MPWO) we see in front of us today, this is obviously something that doesn’t just happen in a day. This has been a long term process that got accelerated in the last 3 years and has been in the works for years by the various governments. Tens of thousands of people have been planning and executing on it. Let’s look back before October 2008 to see what prominent American foreign policy intellectuals were saying about a “multipolar world order”. Was anybody thinking about it? Did they see it coming? What did they think the US should do if it came about? The answer is YES. They were thinking about it, they saw it coming and they made a plan for it.

I have highlighted 4 articles – “The Multipolar World vs The Superpower” by Sherle Schwenninger (Dec, 2003), “China’s Responsibility in a Multipolar World” by Heritage Foundation (Dec, 2004), “New World Disorder” by Tim Ash, The Guardian (Jul, 2006) and “Living in non-polar world” by Richard Haas (Apr, 2008). Sherle Schwenninger postulates that the decreasing economic role of the US on the world scene as early as 2003 made the world multipolar already:

On a global plane, the United States may appear to be the world’s only superpower, spending more than the next 15 nations combined on military power. But viewed at the level of its key strategic relationships with Europe, Russia, China and Japan, the United States in each case needs them to achieve its foreign policy goals as much — or more — than they need the United States. In other words, at the bilateral level, the other established and emerging powers of the world enjoy either strategic parity with the United States — or a favorable balance of power and interest. And the balance is likely to tilt further in favor of Europe, Russia, Japan and China in the future. This is in part because the U.S. market will become less important to them — and in part because the United States’ growing dependence on foreign capital will increase its international debt burden. For much of the last decade, the world has heard repeatedly about the superiority of the American model. But it has been the European Union that has had the most success in exporting democracy and fostering economic reform.

Heritage Foundation and Tim Ash focus on China’s role in this MPWO and whether it will be an “order” at all. Richard Haas of the Council of Foreign Relations in April of 2008 outlines in Project Syndicate opinion how to deal with it all:

Trade also can be a powerful force in a non-polar world by giving states a stake in avoiding conflict, generating greater wealth, and strengthening the foundations of domestic political order – thereby decreasing the chance of state failure as well. A similar level of effort might be needed to ensure the continued flow of investment. The goal should be to create a World Investment Organization, which, by encouraging cross-border capital flows, would minimize the risk that “investment protectionism” impedes activities that, like trade, are economically beneficial and build political bulwarks against instability. A WIO could encourage transparency on the part of investors, determine when national security is a legitimate reason for prohibiting or limiting investment, and establish a dispute-resolution mechanism. Multilateralism may have to be less comprehensive and less formal, at least initially. Networks will be needed alongside organizations. Getting everyone to agree on everything will be difficult; instead, we should consider accords with fewer parties and narrower goals.Trade is something of a model here, insofar as bilateral and regional accords are filling the vacuum created by the failure to conclude a global trade round. Multilateralism à la carte is likely to be the order of the day. This is less than optimal, but in a non-polar world, what is best may well prove the enemy of the possible.

Haas specifically focuses on maintaining trade and investment flows even as the world becomes multipolar and segregates into competing blocs. The core idea here is: we can all hate each other on social level, but we must trade and do business with each other so that we can co-exist with each other. Now, the question is: if the financial systems of these separate economic blocks are separated and diplomatically these blocs are totally at odds with each other and doing business with each other is completely unacceptable on social grounds on the surface, how do you maintain trade and investment flows? Obviously, it’s not going to be an agreed upon solution of some sort. It has to be something that does the job illicitly while everybody swears they have nothing to do with it.

Does that sound like Bitcoin? You bet it does.

In my opinion, Bitcoin is a collaboration between the conservatives in the US and British intelligence services that they dumped right on the eve of the Obama election because they knew the multi-polarization of the world is going to accelerate in its aftermath. The technology needs to be put out there and gain traction so that by the time the actual multi-polarization occurs on a big scale in the mid-2020s the technology has infiltrated the society and matured enough to do its job of as black market that facilitates trade and investment between the East and West.

China

It’s not like China is sleeping here. China also needs something like Bitcoin for its own purposes. The term “Currency Wars” is associated with James Rickards’ book from 2011 that talks about how different states would devalue their currencies against each other to gain an economic advantage and how Gold is bound to benefit from this devaluation as a release valve for all the money printing. The real “Currency Wars” book precedes Rickards by 5 years (released in 2007) and is written by a Chinese author Song Hongbing that became a best-seller in China and particularly popular among the Communist Party bureaucrats. The main point of the book (and its sequels) is that the US will devalue its currency over time and China shouldn’t be the idiot in the relationship and be caught holding a bag of worthless dollars. It states that China needs to develop the Yuan as its own reserve currency and isolate itself financially from the West by 2024. It is 2022 today.

Now, there is only one big problem with this plan: China already has $3 trillion in US denominated foreign exchange reserves and Net Exports that are $1.3 trillion per year, 90% of which is trade with the US and Europe. If China starts dumping Treasuries and dollars for Yuan, the Yuan will appreciate considerably vs the US dollar which will put a big dent the competitiveness of the Chinese economy. The last thing China wants to do is start converting Dollar to Yuan. China would like to convert its dollars to something else but not yuan. China needs a release valve. And what is a more convenient release valve than Bitcoin!

Tracing State Actor’s footsteps in Bitcoin

When the government moves in on an asset class, you can tell. Because the government isn’t moving $100K or $1 million. The government is moving billions. Tens of billions. The realized value of Bitcoin was immaterial until 2017 when all of a sudden it became $90 billion by the end of December of 2017. Somebody or somebodies took $70-80 billion and bought Bitcoin with it in Q4 of 2017. That is a lot of money. Try to buy $1 million of Bitcoin and watch all the hoops you have to jump in the normal financial system. Yet $70-80 billion was bought in a very short time frame from September through December of 2017. Who can put an operation like this and move that much money? Apple’s cash pile is $200 billion. Obviously Apple didn’t do it and no other S&P 500 company has anywhere close to this type of capital. Moreover, if they did they would have to disclose it. So who moved $80 billion sight unseen in Q4 of 2017 right ahead of Trump’s trade war announcement on January 22nd, 2018? Yes, you guessed it. A state actor. A government.

Which government? Obviously, China.

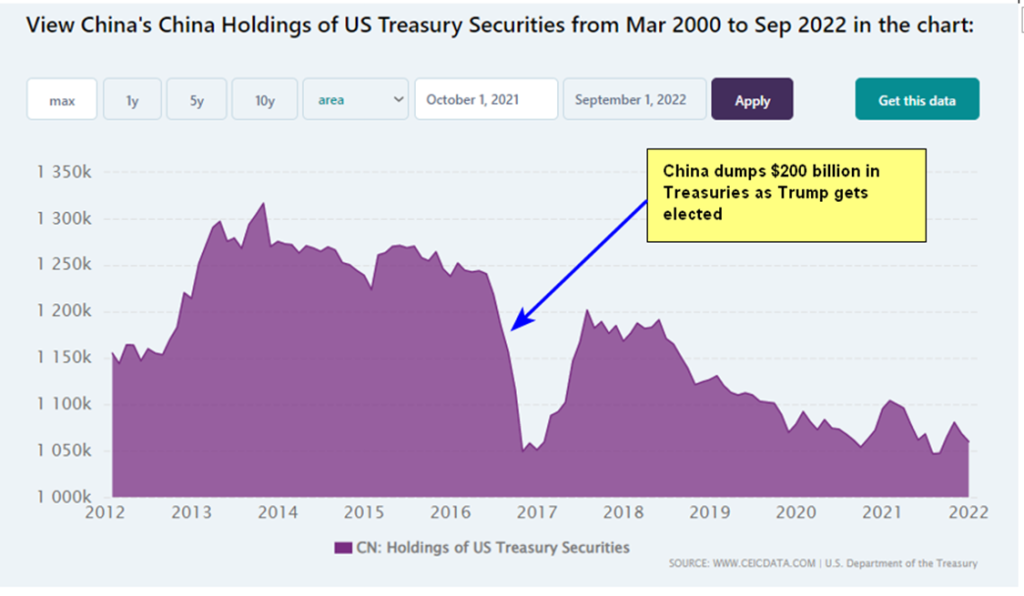

China sees a dramatic reduction in its holdings of US treasuries from $1.25 trillion to $1.05 between June and November of 2016. This is the middle of the campaign election season in which Trump becomes the nominee of the GOP on a distinct anti-China platform. That is a reduction of $200 billion and roughly 15% of its holdings. Clearly China dumped $200 billion in US treasuries in 2016 and then allocated 30% of the money to Bitcoin in 2017 ahead of the start of the trade war when China was expecting that Trump would start levying some form of sanctions. By 2017, the Chinese plan to use Bitcoin as a dumping ground was in place for at least a decade. Bitcoin is how China keeps its currency weak against the US dollar and its options open. And not a surprise, you had massive Bitcoin farms in China at that time with China controlling 60-70% of the world’s hash rate.

The next big jump in realized value in Bitcoin happens in 2021 and that clearly we can trace to the Biden MMT stimulus which caused everybody and their brother to buy Bitcoin as a currency devaluation hedge. The new purchases are massive – $350 billion in additional money. That is 4 times the 2017 amount. Again Elon Musk or Saylor doesn’t have $350 billion in cash. Mom and pop don’t have $350 billion. Bill Miller doesn’t have $350 billion. That money is clearly state money due to the nature of its size. Regardless of what you have heard out there, $100 billion in cash is real money. $350 billion in cash is real real money. I will not be surprised if Chinese and Russian governments were dumping dollar FX reserves into Bitcoin every single day in 2021. And as you can see now with the FTX scandal, the entire Democratic Party was laundering Ukraine war money through Bitcoin in 2021. We are talking big numbers folks.

Some of the world’s governments have already been on the Bitcoin Standard since 2017. Despite Bitcoin’s reputation as a libertarian anon playground, the realized value numbers are simply too big for anons, too big for corporations and too big for pension funds. Only governments can move these types of numbers.

Bonfire of Sanctions

To confirm that the world’s governments are already on the Bitcoin Standard, about a month ago Harvard University published a paper called “Hedging Sanctions Risk: Cryptocurrency in Central Bank Reserves” in which the author Matthew Ferranti outlines how countries under threat of sanctions should use Bitcoin to diversify their foreign exchange reserves. I am not going to go through the paper in detail but the basic idea is that Bitcoin is big enough to be a central bank reserve asset. Bitcoin daily trading volume is about $40 billion USD per day which puts it on par with UK Gilts and German Bunds. When Bitcoin gets to $100 billion in daily volume (which is a “when” not “if”) then Bitcoin will be as liquid as the Gold and US Treasury Bill markets. And it doesn’t get any more liquid than that. In light of the precedent set by US treasury sanctioning Russia – a top 10 economy – over Ukraine, the author concludes no one out there is really safe and that central banks will diversify their dollar holdings in the future.

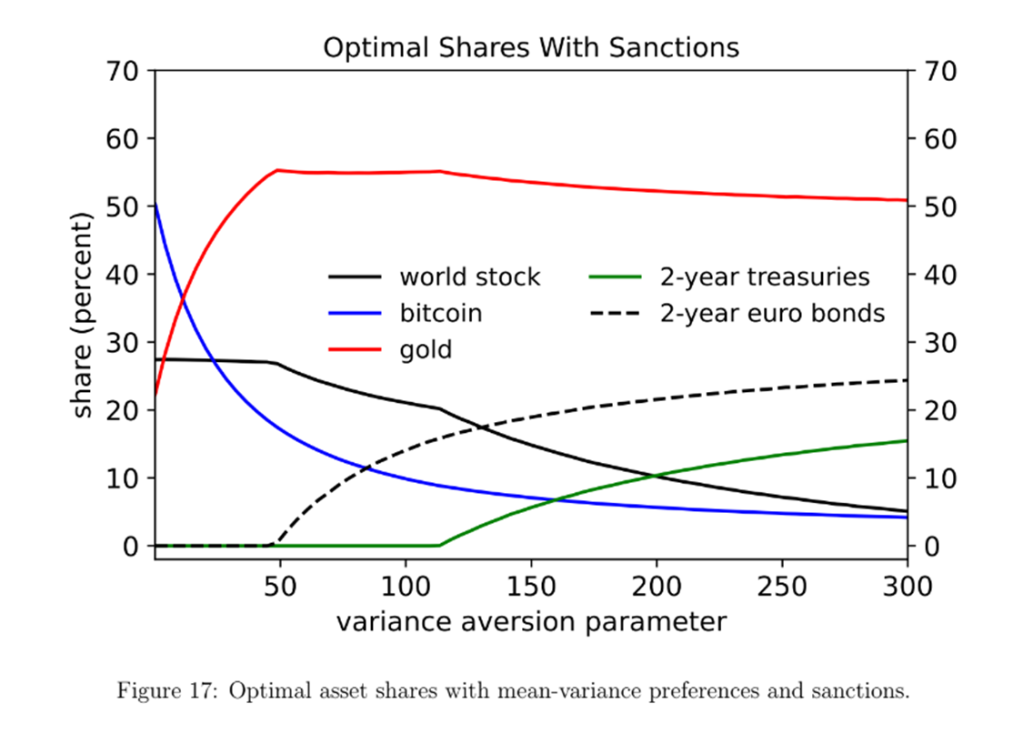

This paper does the calculations and suggests various different options for central banks to diversify into Bitcoin with a “conservative” scenario of 35% Bitcoin, 35% Gold and 30% global stocks and an “aggressive” allocation of 50% Gold, 25% Euro bonds, 15% US treasury bonds, 5% global stocks and 5% Bitcoin. “Conservative” means “wants to lose no money if sanctioned by US and Europe” and “aggressive” means “is ok taking some risk that the US or Europe will not sanction it”.

The paper points out that sanctions are increasingly used for geopolitical purposes and US has applied 4,000 sanctions, EU 2,000 sanctions and the UN 1,000 sanctions. The paper views the chances of the US applying sanctions as twice as high as Europe based on these historical numbers. In addition, sanctions once applied are never taken off. Sanctions applied in the 70s are still around even though the reasons for the sanctions may no longer exist. In other words, all of the sanctions you see flying around with Russia are not going to be rolled back any time soon. Not this year, not next year, not 10 years from now, not 50 years from now. We are observing a permanent separation between East and West on a formal basis.

The author also notes that human rights violations are increasingly used as reasons for sanctions instead of the 2000s reasons such a terrorism or drug trade. Obviously, these categories were too narrow for the activist purposes of the US government and they wanted a broader category which can be more flexible. In that light it is important to note the big importance of the “Respect for Marriage Act” law that was just passed in the US. For the first time on federal level in the US, gay marriage is recognized. 12 GOP senators voted for that including some senators from very conservative states. The reason is not that they like gay marriage, the reason is different. That law now gives the US government the legal means to apply human rights sanctions to countries that don’t recognize gay marriage. That is pretty much all countries in the East and Global South. Russia, for example, just passed a law to ban gay marriage and organized gay group propaganda. Countries in the Muslim world like Saudi Arabia have death penalty for gays, so obviously they won’t be in compliance. The US now can use the gay marriage law to sanction 2/3rds of the countries in the world. Expect the US government to start popping off sanctions like a Pez dispenser in 2023. That in turn will lead to a stampede of Bitcoin buying.

References

The Multipolar World vs The Superpower by Sherle Schwenninger (Dec, 2003)

China’s Responsibility in a Multipolar World by Heritage Foundation (Dec, 2004)

New world disorder by Tim Ash, The Guardian (Jul, 2006)

Living in non-polar world by Richard Haas (Apr, 2008)

Hedging Sanctions Risk by Matthew Ferranti (Nov 2022)